The Government Expands CEBA Loan Facility with Increased Forgivable Amounts

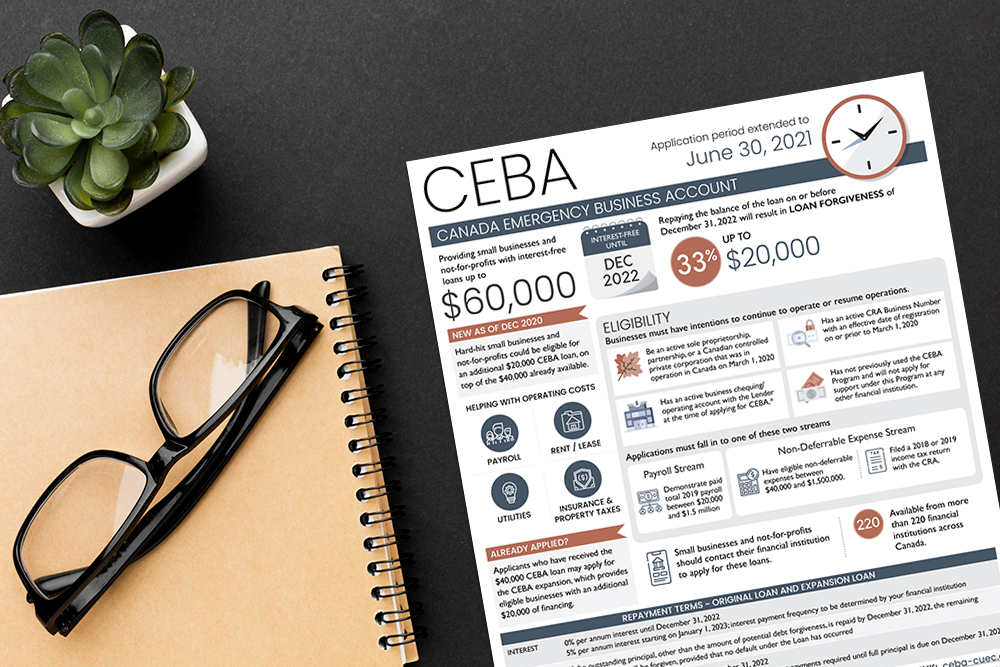

For those who may need a refresher, CEBA (Canada Emergency Business Account) is an interest-free loan program that offers up to $40k, with $10k potentially forgivable if $30k is repaid by December 31, 2022. This program is accessible through regular banks or credit unions, with the government serving as the ultimate decision-maker for qualification.

Recently, the program has been expanded to provide a total loan of $60k, of which up to $20k can be forgivable. Here are some essential details you should know:

Canada Emergency Business Account Loan Expansion Eligibility Requirements and Key Considerations

Determining eligibility for the CEBA (Canada Emergency Business Account) loan expansion can be straightforward, yet slightly more complex than it seems. As per the website, existing applicants who already received a $40k CEBA loan can apply for the $20k expansion, regardless of whether they have repaid the first tranche.

If you already received $40k, you can only apply for the new $20k. However, if you haven’t applied for the $40k yet, you can now apply for the full $60k. To apply, approach the same bank or credit union before the deadline on March 31.

The eligibility criteria remain unchanged. Applicants must demonstrate that they have between $20k-$1.5m in payroll or at least $40k in annualized non-deferrable expenses. It is easier to qualify by meeting the payroll test.

If you already qualified for the $40k, you presumably qualify for the extra $20k. However, please note that you need to adjust your eligible costs by reducing them by other government benefits received. For instance, if your total eligible costs were $50k, and you will receive $13k of wage or rental subsidy under the CEWS or CERS programs, your costs will reduce to $38k, and you may no longer qualify.

It is not clear whether the government will cross-reference your other benefit obligations or whether you will have to do so in your application. Also, your eligibility may have changed since the first $40k, depending on what claims have been filed on your behalf.

Requirements for the CEBA Loan Expansion

Eligibility for the CEBA loan expansion is straightforward, but with a few complexities. According to the official website, businesses that already received the $40k loan may apply for the $20k expansion, regardless of whether they have repaid the first tranche. However, those who have not yet applied for the initial loan may only apply for the full $60k.

To qualify for the loan, businesses must meet the same eligibility criteria as before, which includes having between $20k-$1.5m in payroll or at least $40k in annualized non-deferrable expenses. Those who previously qualified for the $40k loan may qualify for the additional $20k, but they must adjust their eligible costs by reducing them by other government benefits received.

While the CRA website does not mention demonstrating hardship, certain commentators have indicated that businesses will need to attest that COVID-19 has had an impact on their operations. The attestation process may vary from lender to lender, but it typically requires businesses to certify that they are facing ongoing financial hardship, intend to continue or resume their operations, have made reasonable efforts to reduce costs and improve viability, and have only used the loan for eligible non-deferrable expenses. The verbiage for the attestation may vary, but businesses should pay close attention to the first item, which is highly subjective.

What’s the process and what do you get out of it?

You can now apply for an additional loan of $20k on top of your existing CEBA loan, and $10k of that may be forgiven if you meet certain requirements. This means that you have the potential to receive up to $20k of “free money” on a $60k loan.

To qualify for the forgivable portion of the loan, you must repay all outstanding balances by December 31, 2022. The repayment criteria remain the same as before, except now you need to repay $40k by that date instead of $30k.

What to do with the CEBA loan? Our advice.

If you’re eligible for the CEBA loan expansion, we recommend taking advantage of it as it’s essentially free money. However, it’s important to use the funds for their intended purpose, and not to simply deposit the money into a GIC or other savings account. Instead, deposit the funds into your regular bank account to ensure they are properly mapped against the expenses they’re intended to support.

We also advise setting up a repayment schedule to ensure the loan is paid back by the required deadline of December 31, 2022. Repayments cannot begin before April 1, 2021, but a repayment plan of $2,000 per month starting on May 1, 2021, will ensure the $40k repayment requirement is met by the deadline, making you eligible for the remaining $20k to be forgiven.

Remember, the CEBA loan is intended to support your business’s cash flow during these uncertain times, so use it wisely and in line with the program’s spirit.