When businesses embark on mergers and acquisitions (M&A) journeys in Canada, one crucial aspect that demands meticulous attention is taxes. The intricate tax landscape can significantly impact the success and financial outcomes of these transactions. In this blog post, we will explore the realm of M&A services, navigating mergers and acquisitions, for taxes in Canada, shedding light on their significance and the critical role they play in ensuring seamless and tax-efficient deals.

Navigating Mergers and Acquisitions

Mergers and acquisitions come with a myriad of tax implications that can influence the structure, timing, and overall feasibility of a deal. Expert tax services play an instrumental role in assessing the potential tax consequences, including capital gains tax, transfer pricing, and more.

Understanding Tax Implications:

Mergers and acquisitions carry a multitude of tax implications that hold the power to shape the framework, timing, and overall viability of a transaction. Proficient tax services play a pivotal role in evaluating the possible tax outcomes, encompassing factors like capital gains tax, transfer pricing, and other pertinent considerations.

Tailoring Tax Strategies:

A one-size-fits-all approach simply doesn’t work when it comes to M&A taxes. Skilled tax advisors craft tailored strategies that align with the specific goals of the businesses involved. This includes evaluating whether asset purchases or share purchases are more advantageous from a tax perspective.

When it comes to M&A taxes, a universal solution isn’t effective. Competent tax advisors construct customized strategies that harmonize with the unique objectives of the participating businesses. This encompasses assessing whether asset purchases or share acquisitions offer superior tax advantages.

Due Diligence:

Thorough due diligence is a cornerstone of successful M&A transactions. Tax experts conduct comprehensive reviews of financial records to uncover any hidden tax liabilities that could impact the deal’s financial viability.

In our upcoming posts, we will delve deeper into the specific tax considerations surrounding mergers and acquisitions in Canada, exploring topics such as cross-border transactions, tax-efficient structuring, and post-deal integration strategies.

Mergers and acquisitions (M&A) are complex transactions that can have significant financial and strategic implications for businesses. In Canada, as in many other countries, these transactions are subject to a complex web of tax regulations and considerations. Navigating the tax aspects of M&A is crucial for both buyers and sellers to optimize the deal’s structure and outcomes.

- Due Diligence Services: Before entering into an M&A deal, it’s essential to conduct thorough due diligence to identify potential tax risks and opportunities. Tax due diligence services help businesses assess the financial implications of the transaction, including tax liabilities, compliance, and exposure to potential audits.

- Structuring and Planning: Proper structuring and planning of the M&A deal can have a significant impact on tax liabilities and cash flow. Tax professionals in Canada assist businesses in designing the most tax-efficient structure for the transaction, whether it’s a share purchase, asset purchase, or merger.

- Tax Compliance and Reporting: Staying in compliance with Canadian tax regulations is crucial to avoid penalties and legal issues. Tax experts provide guidance on tax reporting requirements related to M&A, ensuring that all necessary documents and filings are completed accurately and on time.

- Tax Optimization: Tax professionals help businesses identify opportunities to optimize tax outcomes during M&A transactions. This may involve utilizing available tax credits, loss carryforwards, and other incentives to reduce the overall tax burden.

- Transfer Pricing Analysis: In cases involving international transactions, transfer pricing analysis is essential to ensure that transactions between related entities are conducted at arm’s length. This helps prevent transfer pricing disputes and ensures compliance with Canada’s transfer pricing regulations.

- Valuation Services: Determining the fair market value of assets and liabilities is a critical aspect of M&A transactions. Valuation services assist businesses in assessing the tax implications of various valuation methods, ensuring that the transaction is conducted at a fair and compliant value.

- Post-Merger Integration: After the deal is completed, tax professionals can help businesses with post-merger integration, including aligning financial systems, consolidating operations, and managing ongoing tax compliance.

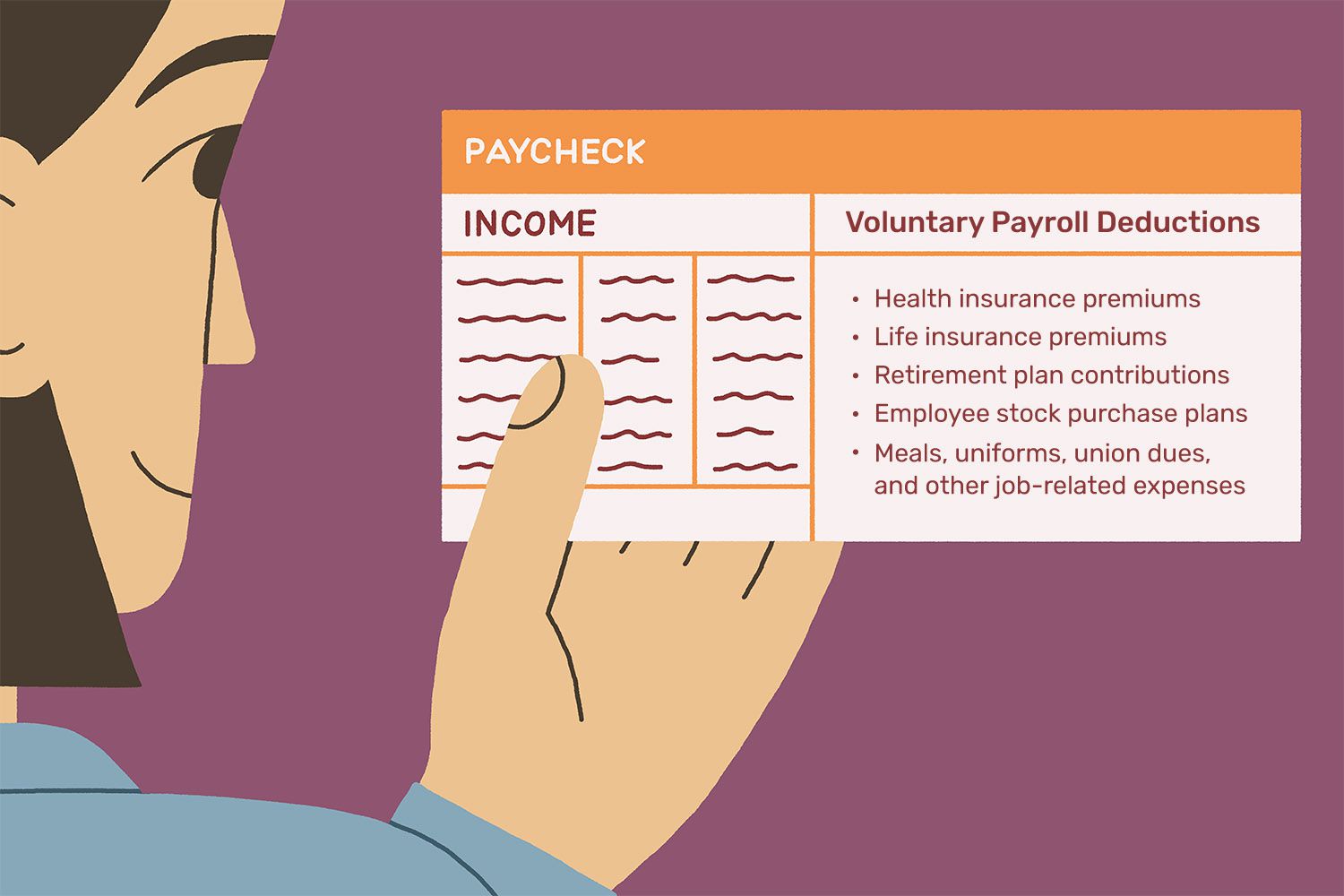

- Employee Compensation and Benefits: M&A transactions can have a significant impact on employee compensation and benefits plans. Tax experts help businesses address issues related to employee stock options, retirement plans, and other benefits during and after the merger or acquisition.

- Sales and Use Tax Advisory: In addition to income tax considerations, businesses must also navigate sales and use tax implications related to M&A transactions. Tax professionals provide guidance on how these taxes may apply and how to manage compliance.

- Tax Litigation Support: In the event of disputes or disagreements with tax authorities, tax professionals can offer litigation support to protect your business’s interests and resolve tax-related issues.

Navigating mergers and acquisitions are intricate transactions that require careful consideration of tax implications in Canada. By leveraging the expertise of tax professionals and specialized tax services, businesses can navigate these complex processes with confidence. Whether you’re a buyer or a seller, proper tax planning and compliance are essential for achieving your financial and strategic objectives in M&A transactions. Working with experienced tax professionals ensures that your business remains compliant with Canadian tax regulations and maximizes the financial benefits of the deal.

For businesses operating in Ottawa, understanding the intricacies of payroll taxes is essential to ensure compliance and avoid penalties. In this blog post, we’ll provide a comprehensive guide to understanding Ottawa payroll taxes and the responsibilities of employers in handling them.

Also read: Demystifying Income Taxes in Canada: A Comprehensive Guide

Types of Payroll Taxes in Ottawa for Navigating Mergers and Acquisitions:

Ottawa businesses are subject to several types of payroll taxes, including federal and provincial income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums. We’ll break down each tax type, explaining how they are calculated and the corresponding deductions from employee salaries.

Calculating Ottawa Payroll Taxes:

Calculating payroll taxes accurately is vital to avoid errors that could lead to costly penalties. We’ll provide step-by-step guidance on calculating various payroll taxes in Ottawa, considering factors such as income brackets, CPP and EI limits, and any applicable tax credits or deductions.

Remitting Payroll Taxes:

Deadlines and Reporting Requirements: Employers in Ottawa have specific deadlines for remitting payroll taxes and reporting them to the appropriate authorities. We’ll outline these deadlines and reporting requirements, emphasizing the importance of timely and accurate submissions to stay compliant with tax regulations.

Managing Statutory Deductions and Contributions:

Ottawa businesses must deduct certain amounts from employees’ paychecks for various statutory obligations, such as income tax and CPP contributions. We’ll explain the responsibilities of employers in managing these deductions and ensuring they are remitted to the appropriate agencies as required by law.

Handling Payroll Audits and Ensuring Compliance:

Payroll audits by government agencies can be a daunting prospect for employers. We’ll discuss strategies for preparing and managing payroll audits in Ottawa, ensuring your business complies with the audit process and presents accurate payroll records.

Conclusion:

Navigating Ottawa’s payroll tax landscape requires a clear understanding of the tax types, calculation methods, reporting deadlines, and compliance requirements. By adhering to these guidelines and seeking professional assistance when needed, employers in Ottawa can effectively manage their payroll taxes and fulfill their responsibilities as tax-paying entities.