As you delve deeper into the world of income taxes in Canada, it’s crucial to recognize the distinction between Provincial vs. Federal taxes. These two layers of taxation play a significant role in determining your overall tax liability.

Provincial vs. Federal Taxes

Federal income taxes

They are collected by the Canadian government and apply to all individuals across the country. The federal government sets tax brackets and rates, which become progressively higher as your income increases. This means that the more you earn, the greater the percentage of your income that you’ll owe in federal taxes. These taxes are collected by the Canadian government and are applicable to all individuals throughout the country. The federal government establishes tax brackets and rates that gradually escalate as your income rises. In essence, the more you earn, the larger the proportion of your income that you will owe in federal taxes.

Provincial and Territorial income taxes

On the other hand, provincial and territorial income taxes are administered by the respective local governments. Each province and territory has its own unique tax brackets, rates, and regulations. Some provinces have higher taxes to fund additional services, while others have lower taxes to attract businesses and residents. Conversely, provincial and territorial income taxes are managed by their respective local governments. Every province and territory operates with its distinct tax brackets, rates, and regulations. Some provinces implement higher taxes to support additional services, whereas others offer lower tax rates as incentives to attract businesses and residents.

When you file your tax return, you’ll calculate both federal and provincial/territorial taxes separately. Remember that the total amount you owe may vary depending on your location and income level. It’s also essential to factor in available tax credits and deductions, which can differ between federal and provincial tax systems.

While federal income taxes are consistent throughout Canada, provincial and territorial taxes create a dynamic landscape that demands careful consideration. Familiarize yourself with the specific tax rules of your province or territory, and consult with tax professionals if necessary to ensure accurate reporting and optimization of your tax liabilities.

Income tax is an integral part of life in Canada, supporting essential services and infrastructure at both the federal and provincial/territorial levels. If you’re earning income in Canada, it’s crucial to understand the differences between federal and provincial income taxes to ensure accurate and compliant tax filings. In this blog post, we’ll guide you through the complexities of navigating income taxes in Canada.

Federal Income Tax in Canada

The federal income tax in Canada is collected by the Canada Revenue Agency (CRA) and provides revenue to the federal government. Here’s what you need to know about federal income tax and Provincial vs. Federal Taxes:

- Progressive Tax System: Canada’s federal income tax operates on a progressive system. This means that the more you earn, the higher your tax rate. Federal tax rates change annually, and there are multiple tax brackets based on your income level.

- Filing Deadline: The annual deadline for filing your federal tax return is April 30th. If you or your spouse or common-law partner operate a business, you have until June 15th to file, but any balance owing is still due by April 30th.

- Federal Tax Credits and Deductions: The federal government offers various tax credits and deductions to reduce your overall tax liability. These can include credits for children, education expenses, medical expenses, and more.

Provincial/Territorial Income Tax in Canada

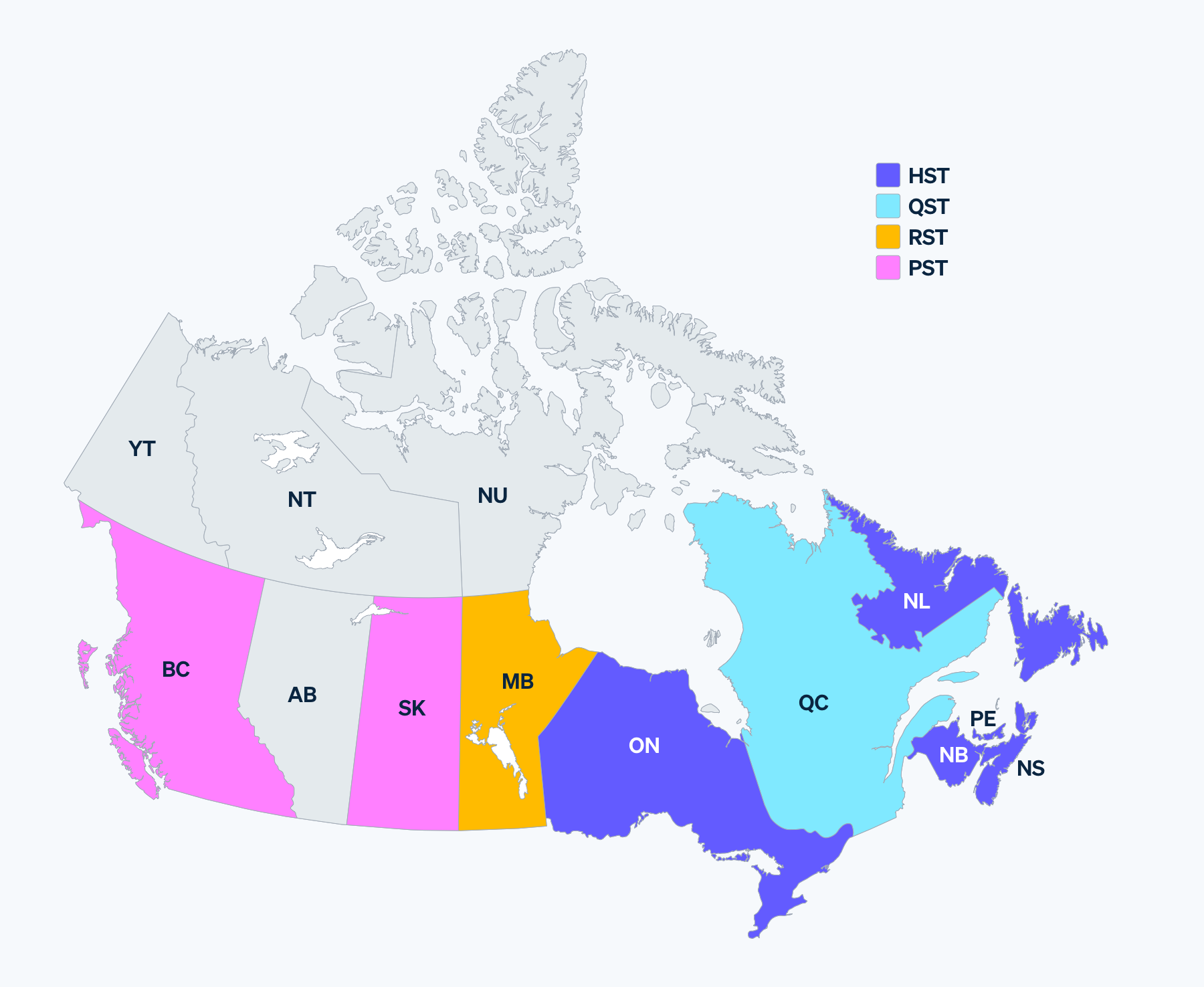

In addition to federal income tax, each province and territory in Canada has its own tax authority, which levies provincial or territorial income tax. Here are some key points about provincial/territorial income tax and Provincial vs. Federal Taxes:

- Varied Rates: Provincial/territorial income tax rates vary from one jurisdiction to another. Some provinces have a flat rate, while others use a progressive tax system similar to the federal government.

- Tax Brackets: Just as with federal income tax, provinces and territories have their own tax brackets and rates, which may change annually.

- Tax Credits and Deductions: Provinces and territories may offer their own tax credits and deductions in addition to federal benefits. These can vary widely, so it’s essential to be aware of the specific programs available in your region.

Filing Your Taxes

When it comes to filing your income tax return in Canada, you’ll typically have to file both a federal return and a provincial/territorial return. Here’s how the process works:

- Federal Return: Your federal return is submitted to the CRA, and it covers your income, deductions, and credits at the federal level.

- Provincial/Territorial Return: Your provincial/territorial return, often called a T1 return, is filed with the tax authority of your specific province or territory. It includes your provincial/territorial income, deductions, and credits.

- Combined Return: Many tax preparation software and services allow you to file both federal and provincial/territorial returns in one seamless process.

Tax-Free Savings Account (TFSA) and Registered Retirement Savings Plan (RRSP)

Two popular tax-advantaged savings tools in Canada are the Tax-Free Savings Account (TFSA) and the Registered Retirement Savings Plan (RRSP):

- TFSA: Contributions to a TFSA are not tax-deductible, but any income or capital gains earned within the account are tax-free. You can withdraw funds from your TFSA at any time without incurring taxes.

- RRSP: Contributions to an RRSP are tax-deductible, reducing your taxable income for the year. However, withdrawals from an RRSP are considered taxable income, typically made during retirement when your tax rate may be lower.

Also read: The Role of Professional Accountants in Cloud Accounting for Canadian Businesses

Navigating income taxes in Canada involves understanding both federal and provincial/territorial tax systems. It’s essential to stay informed about the latest tax rates, credits, and deductions to maximize your financial benefits and ensure compliance with tax laws. Consulting with a tax professional or using reputable tax preparation software can help simplify the process and ensure accurate and timely filings, whether you’re a resident or non-resident earning income in Canada.

Understanding the Basics of Income Taxes in Canada

Income taxes are a crucial aspect of any country’s financial system, and Canada is no exception. As a responsible citizen, it’s important to understand the basics of how income taxes work in the Great White North.

In Canada, the federal government and provincial or territorial governments collect income taxes. The amount you owe depends on your total income, deductions, and tax credits. Canada operates on a progressive tax system, meaning that as your income increases, the percentage of tax you pay also increases.

Basics of Income Taxes in Canada

The federal government has different tax brackets, with higher incomes being taxed at a higher rate. Additionally, each province and territory has its own set of tax brackets and rates, which can sometimes differ significantly from the federal rates. This means that your total tax liability may vary based on where you live.

Tax Withholding

To ensure that income taxes are accurately calculated, employers deduct a portion of your earnings as “tax withholding” throughout the year. When you file your annual tax return, you reconcile these withholdings with your actual tax liability. If you’ve overpaid, you’ll receive a refund, while if you’ve underpaid, you’ll need to settle the difference. To ensure the accurate calculation of income taxes, employers deduct a portion of your earnings as “tax withholding” throughout the year. When you file your annual tax return, you reconcile these withheld amounts with your actual tax liability. If you have paid more than what you owe, you will be eligible for a refund. Conversely, if you have paid less than your tax obligation, you will be required to make up the difference.

Remember, various deductions and tax credits can reduce your taxable income, potentially lowering your overall tax bill. Common deductions include RRSP contributions, student loan interest, and childcare expenses, among others. Familiarizing yourself with these deductions and credits can significantly impact the final amount you owe.

Understanding the basics of income taxes in Canada is vital for managing your personal finances effectively. Keep track of tax changes and regulations in your province or territory, utilize available deductions and credits, and ensure accurate reporting to avoid any surprises during tax season.

Taxes are an essential part of any country’s financial system, and Canada is no exception. If you’re living and earning income in the Great White North, it’s crucial to have a basic understanding of income taxes. In this blog post, we’ll break down the fundamentals of income taxes in Canada to help you navigate the tax season with confidence.

Types of Income

In Canada, income and Provincial vs. Federal Taxes are divided into several categories, each with its own tax treatment. Here are the most common types:

- Employment Income: This includes your salary, wages, bonuses, and any other compensation you receive from your job. It’s subject to federal and provincial/territorial taxes.

- Business Income: If you’re self-employed or run a business, you’ll need to report your business income. This category includes income from sole proprietorships, partnerships, and corporations.

- Investment Income: This encompasses interest, dividends, and capital gains from investments such as stocks, bonds, and real estate. Some of this income may qualify for preferential tax rates.

- Rental Income: If you earn money by renting out property, you’ll need to declare rental income. Certain expenses related to property rentals can be deducted from your taxable income.

- Other Income: This category includes any income that doesn’t fit into the above categories, such as alimony, pension income, and social assistance payments.

Taxation Levels

In Canada, income taxes are collected at both federal and provincial/territorial levels. The federal government imposes taxes through the Canada Revenue Agency (CRA), while each province and territory has its own tax authority.

- Federal Tax: The federal government collects income tax based on a progressive tax system, meaning the more you earn, the higher your tax rate. Federal tax rates are set annually and can vary depending on your income bracket.

- Provincial/Territorial Tax: In addition to federal taxes, provinces and territories impose their own taxes. The rates and income brackets for provincial or territorial taxes also differ from one jurisdiction to another.

Filing Your Tax Return

Filing your tax return is an annual responsibility for most Canadians. The tax year in Canada typically runs from January 1st to December 31st. Here’s what you need to know about filing your taxes:

- Due Date: The deadline for filing your tax return is April 30th for most individuals. If you or your spouse or common-law partner run a business, the due date is June 15th, but any balance owing is still due by April 30th.

- Methods of Filing: You can file your taxes online using tax software, through a certified tax professional, or by mailing a paper return.

- Tax Credits and Deductions: Canada offers a variety of tax credits and deductions that can reduce your overall tax liability. These include the Canada Child Benefit (CCB), the GST/HST Credit, tuition credits, and more.

Tax-Free Savings Account (TFSA) and Registered Retirement Savings Plan (RRSP)

Two popular tax-advantaged savings vehicles in Canada are the TFSA and RRSP:

- TFSA: Contributions to a TFSA are not tax-deductible, but any income or capital gains earned within the account are tax-free. You can withdraw funds from your TFSA at any time without incurring taxes.

- RRSP: Contributions to an RRSP are tax-deductible, reducing your taxable income for the year. However, withdrawals from an RRSP are considered taxable income, typically made during retirement when your tax rate may be lower.

Tax Credits for Special Circumstances

Canada offers various tax credits to support individuals in specific circumstances:

- Child Care Expenses: If you have dependent children and incur childcare costs, you may be eligible for the Child Care Expense Deduction.

- Disability Tax Credit: Individuals with disabilities may qualify for this non-refundable tax credit, which can provide financial relief.

- First-Time Home Buyers’ Credit: If you’re purchasing your first home, you may be eligible for this credit, which can reduce your overall tax liability.

Conclusion

Understanding the basics of income taxes in Canada Provincial vs. Federal Taxes is a valuable skill that can help you manage your finances and make informed decisions about your money. While this overview provides a general understanding, it’s essential to consult with a tax professional or use reputable tax software when preparing and filing your tax return to ensure compliance with the latest tax laws and regulations.