A recent survey we conducted reveals that every Canadian believes their province has the highest tax burden. But is that perception accurate? In Canada, our income tax rates are influenced by two factors: our income level and our place of residence. It is commonly perceived that Quebecers bear the highest tax burden among all provinces for tax disparities.

Tax Disparities: A Look at Income Tax Rates Across Canadian Provinces

When it comes to income taxes in Canada, the percentage you pay depends on your income level and where you reside. This system utilizes tax brackets, where the initial dollars earned by taxpayers are taxed at a lower rate tax disparities, while higher amounts are subject to progressively higher rates.

Across the country, federal income Tax Disparities rates for 2019 are structured as follows:

- 15% on the first $47,630 of taxable income

- 20.5% on the next $47,629 (taxable income over $47,630 up to $95,259)

- 26% on the next $52,408 (taxable income over $95,259 up to $147,667)

- 29% on the next $62,704 (taxable income over $147,667 up to $210,371)

- 33% on taxable income over $210,371

However, the tax burden extends beyond federal taxes. Each province and territory has its own unique tax brackets, which impacts the overall tax payments for residents.

Also read: Demystifying Income Taxes in Canada: A Comprehensive Guide

Considering a taxable income of $65,000, here is a breakdown of provincial taxes paid in 2019:

- Newfoundland and Labrador: $7,244.72

- Prince Edward Island: $7,690.64

- Nova Scotia: $7,993.90

- New Brunswick: $7,443.76

- Quebec: $10,801.50

- Ontario: $4,147.35

- Manitoba: $7,650.43

- Saskatchewan: $7,220.49

- Alberta: $6,500.00

- British Columbia: $3,930.33

- Yukon: $4,611.62

- Northwest Territories: $4,425.29

- Nunavut: $3,187.58

While Quebec residents pay the highest provincial taxes in this scenario, it’s important to note that they also benefit from a 16.5% federal tax abatement. Other provinces may have varying federal tax reductions as well.

In conclusion, the perception that Quebecers pay the highest taxes in Canada is accurate when considering provincial taxes alone. However, the overall tax burden, including federal and provincial taxes combined, may differ based on individual circumstances and applicable tax abatements.

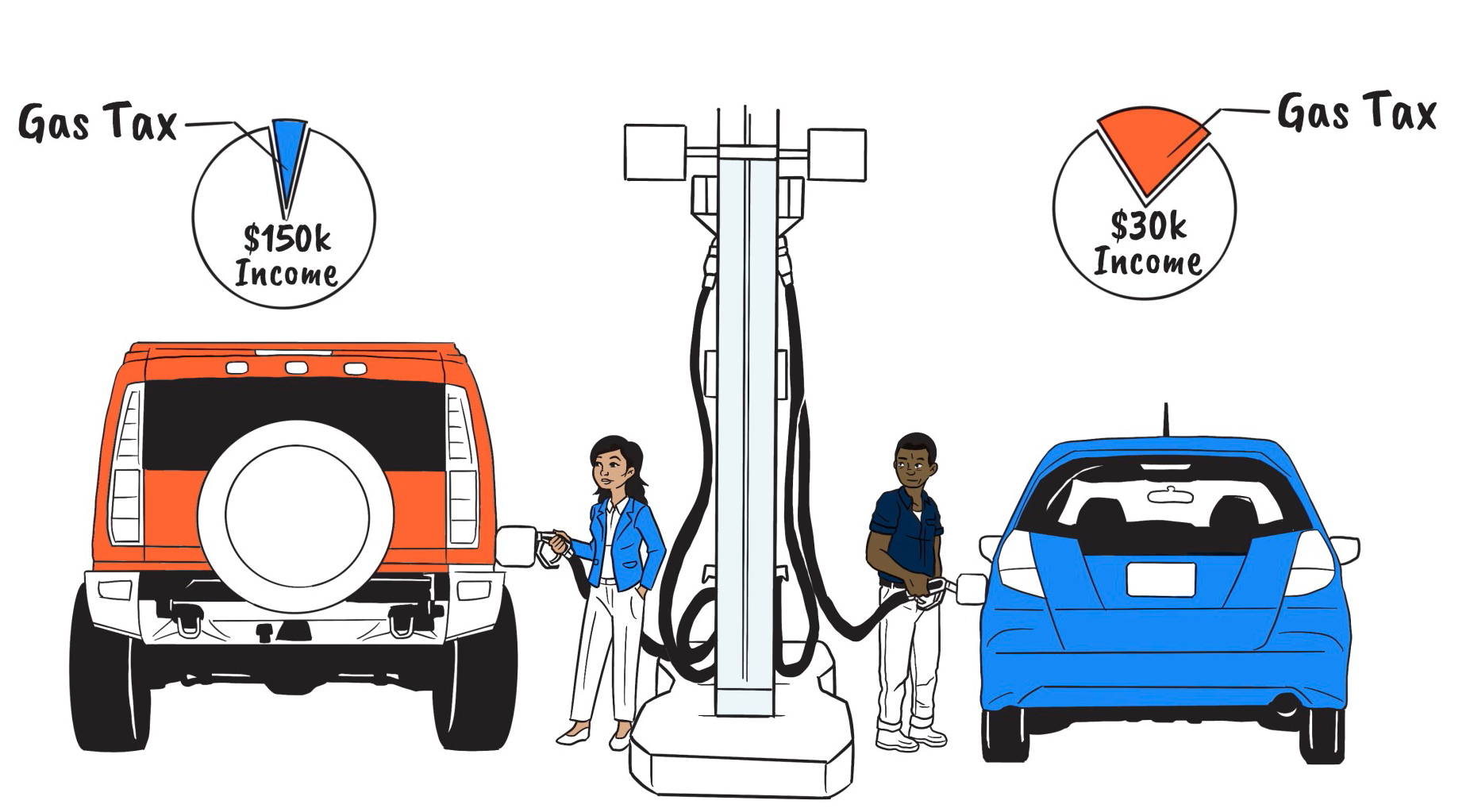

Understanding Tax Brackets: Making More, Paying More

In Canada, our tax system follows a progressive structure, meaning that individuals with higher incomes are taxed at higher rates. This system is organized into tax brackets, where the first portion of income is taxed at a lower rate, and as income increases, higher rates are applied. Moreover, tax rates can vary based on the province or territory of residence. Let’s explore how this impacts the tax burden for Canadians across different locations.

Federal Income Tax Brackets for 2019:

- 15% on the first $47,630 of taxable income

- 20.5% on the next $47,629 of taxable income (portion over $47,630 up to $95,259)

- 26% on the next $52,408 of taxable income (portion over $95,259 up to $147,667)

- 29% on the next $62,704 of taxable income (portion over $147,667 up to $210,371)

- 33% on taxable income over $210,371

Province and Territory Tax Brackets for 2019 (based on a taxable income of $65,000):

- Quebec: $10,801.50

- Ontario: $4,147.35

- British Columbia: $3,930.33

- Alberta: $6,500.00

- Manitoba: $7,650.43

- Saskatchewan: $7,220.49

- Nova Scotia: $7,993.90

- New Brunswick: $7,443.76

- Prince Edward Island: $7,690.64

- Newfoundland and Labrador: $7,244.72

- Yukon: $4,611.62

- Northwest Territories: $4,425.29

- Nunavut: $3,187.58

Location Matters:

When it comes to taxes, location matters. Different provinces and territories have varying tax rates, resulting in different tax burdens for residents. Based on a taxable income of $65,000, Quebec residents face the highest taxes, while Nunavut residents experience the lowest tax burden.

It’s important to remember that the federal tax amount is reduced by non-refundable tax credits, like the federal basic amount. These credits help reduce the overall tax liability.

In conclusion, the progressive tax system ensures that higher-income earners contribute a larger share of their income towards taxes. By understanding tax brackets and regional tax rates, Canadians can make informed financial decisions to manage their tax obligations effectively.

Unexpected Surprises for Quebec Families as Economic Surplus Unveiled

Exciting news awaits Quebec families as the holiday season approaches! On November 7, 2019, the provincial government economic unveiled its plan to distribute the budget surplus directly to its residents, turning it into a generous gift. So, what’s in store? Brace yourselves, Quebecers, as the government has committed to redistributing a minimum of $3.3 billion over the next five years. If you’re a resident, get ready for a significant windfall coming your way. It’s time for some serious cha-ching!

Also read: The Role of Professional Accountants in Cloud Accounting for Canadian Businesses

Understanding Quebec’s New Changes: Who, How Much, and When?

Say goodbye to costly childcare expenses. The Quebec government has reintroduced a previous measure, implementing a single reduced rate for subsidized childcare services starting this year for 2019 tax returns. This means that approximately 140,000 families will save an average of $1,100 annually. But that’s not all! The reduction will be retroactively applied from the beginning of 2019, resulting in more money back in your pocket when you file your taxes.

Economic Unveiled: Equal treatment is another significant change.

The government has accelerated the enhancement of the Family Allowance, which was originally scheduled for 2022. Starting in the new year, nearly 679,000 families will receive an additional average of $779 per year. Currently, the minimum amount per child is $1,000, and the maximum Family Allowance paid to parents will increase to $2,515 per child, up from $1,735. Furthermore, benefits will be equal for all children within the same family, eliminating the need for preferential treatment.

Support for disabled children is also a priority.

The government announced the addition of a second tier of assistance to the supplement for disabled children requiring exceptional care. This means that those who previously didn’t qualify will now receive an additional monthly payment of $652, while more severely disabled children who qualify under the first tier will receive $978. It’s important to note that this assistance will be paid separately from the tax return for tax disparities.

Changes have been made to the solidarity tax credit as well.

If you belong to a low or middle-income family, pay close attention. Previously, taxpayers had to file a tax return to receive the solidarity tax credit. However, this requirement has been waived for social assistance recipients who did not file their 2018 tax return by December 2018. While this is good news, there’s a catch. Each adult will now only receive the basic amount of $292 for the period from July 2019 to June 2020, which will be paid at the end of this period.

Additionally, there are other supplementary amounts that you’ll only be eligible for if you file a tax return, including the $139 additional amount for a person living alone, the $567 housing component, and the $1,719 component for individuals living in northern villages.